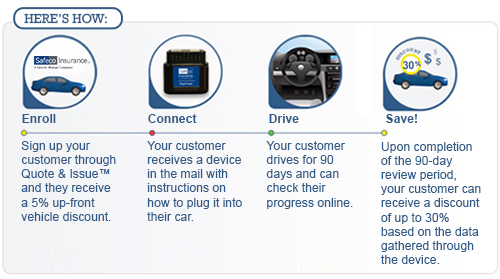

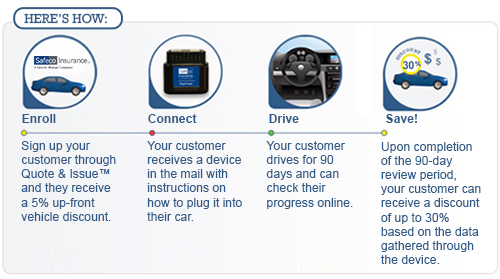

How SafeCo RightTrack® could Save You 30% on Your Auto Insurance

Do you feel like you are a good driver and deserve a discount? Well, now is your chance to save money on your car insurance! A guaranteed 5% savings and up to 30% for the best drivers.

Do you feel like you are a good driver and deserve a discount? Well, now is your chance to save money on your car insurance! A guaranteed 5% savings and up to 30% for the best drivers.

You own a condo or townhome and might be unsure what you need for coverage. Condo and townhome insurance is usually different than insuring a single family home.

Here are some comments from Safeco clients who recently experienced a claim in 2015.

Did you know that most insurance companies offer a discount if your child is at college and does not have access to one of your vehicles on a regular basis.

The problem is that these shingles were discontinued in the mid 2000's. It is tough to get proper home insurance coverage if your home has the T-lock shingle.

The same insurance coverage from your personal auto insurance policy will extend over to that rental car....