What is Pet Insurance and How Does it Work?

Pet insurance is becoming increasingly popular and necessary. Many of our clients ask us questions about the coverage so our insurance agents put together a list of frequently asked questions.

Pet insurance is becoming increasingly popular and necessary. Many of our clients ask us questions about the coverage so our insurance agents put together a list of frequently asked questions.

The basic reason to purchase Denver wedding and event insurance is to protect you for circumstances that are out of your control. You have planned a special day and the insurance will give you added peace of mind.

Does it seem like driving has become more expensive in Colorado in recent years? You’re not alone and your insurance cost likely has increased.

Have you ever wondered if you have enough life insurance? Take our life insurance survey or answer the below questions. It should help you in determining if you have enough life insurance:

It’s a great idea to review your insurance coverage with your insurance agent once a year. Life events happen and life changes throughout the years. The insurance agents at Denver Insurance understand that you’re busy and insurance isn’t the most exciting topic but a quick conversation can ensure that you have the correct insurance coverage. If nothing else, it’s a good refresher on your coverage.

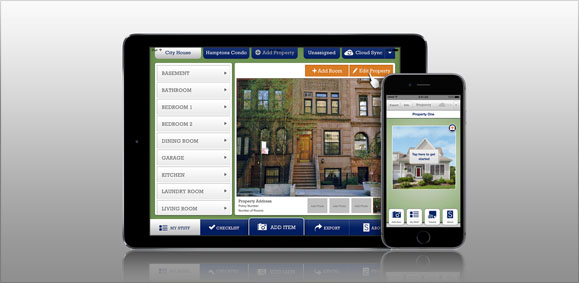

It’s not required but it is a great idea! If anything happens, whether it be a fire, theft or tornado claim, an inventory will help you identify what was lost. Luckily, one of our insurance partners, Safeco Insurance, offers a free home inventory app.

At Denver Insurance LLC, an insurance agent can help you with a free quote. There are numerous discounts available for motorcyle insurance.

If you are a renter, you should have renters insurance. Your personal belongings could be covered for under $10 per month!

One of the most important things you can do is adding coverage for OEM replacement parts.

Winter storms mean icy roads and increased risks to your home.