How Much Insurance Coverage Should I Have On My Home?

It’s great that the market value of your house is increasing. But do you need to increase the coverage on your homeowner's insurance?

It’s great that the market value of your house is increasing. But do you need to increase the coverage on your homeowner's insurance?

I was asked recently, "what is the biggest pitfall people make when planning their own event?" That's an enormous question.

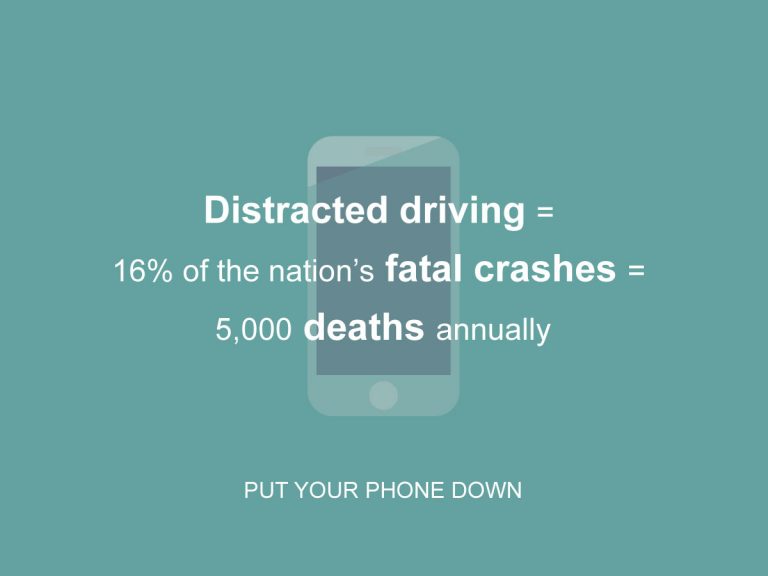

Does it seem like driving has become more expensive in Colorado in recent years? You’re not alone and your insurance cost likely has increased.

Have you ever wondered if you have enough life insurance? Take our life insurance survey or answer the below questions. It should help you in determining if you have enough life insurance:

Your business is your livelihood! Coverage for body shops and mechanics can be complicated but Denver Insurance is here to help!

It’s a great idea to review your insurance coverage with your insurance agent once a year. Life events happen and life changes throughout the years. The insurance agents at Denver Insurance understand that you’re busy and insurance isn’t the most exciting topic but a quick conversation can ensure that you have the correct insurance coverage. If nothing else, it’s a good refresher on your coverage.

We encourage our clients to do as much research as possible because you should be 100% comfortable with your insurance selection.

Life insurance can be as simple or as complicated as you want to make it. Basically, there are 2 types of life insurance.

Simply put, an insurance score is different than a credit score but the usage is similar. Insurance companies use your insurance score to establish your insurance premium. Each insurance company uses their own algorithm to assign you an insurance score. The better your score, the better your insurance rate.

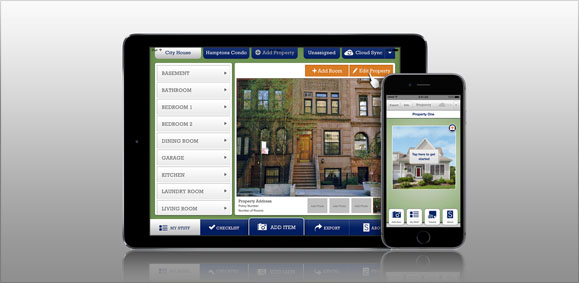

It’s not required but it is a great idea! If anything happens, whether it be a fire, theft or tornado claim, an inventory will help you identify what was lost. Luckily, one of our insurance partners, Safeco Insurance, offers a free home inventory app.