Winter Storms Arrive: Are You Ready?

Winter storms mean icy roads and increased risks to your home.

Winter storms mean icy roads and increased risks to your home.

For an average of $2 per month, you can add Equipment Breakdown Coverage to your home insurance and cover your appliance for sudden and accidental stoppage from a broken part

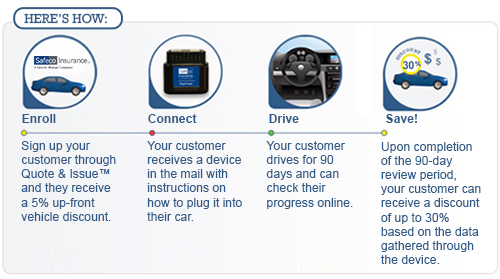

Do you feel like you are a good driver and deserve a discount? Well, now is your chance to save money on your car insurance! A guaranteed 5% savings and up to 30% for the best drivers.

You own a condo or townhome and might be unsure what you need for coverage. Condo and townhome insurance is usually different than insuring a single family home.

The Colorado Holiday Season is one of the best times of the year! It is a time filled with fun, family and friends but also potential hazards. After you find the perfect Christmas sweater for your holiday party, read this blog for holiday safety tips.

If you have assets or a good income, then the simple answer is, yes! A personal liability umbrella policy is an inexpensive way to give you additional peace of mind and protect your assets.

Let’s face it, unfortunately, accidents happen. That’s why you have car insurance. Each scenario can be unique but we’ll discuss the most common occurrences.

Here are some comments from Safeco clients who recently experienced a claim in 2015.

Did you know that most insurance companies offer a discount if your child is at college and does not have access to one of your vehicles on a regular basis.

Here are 3 factors that will help you save on car insurance: